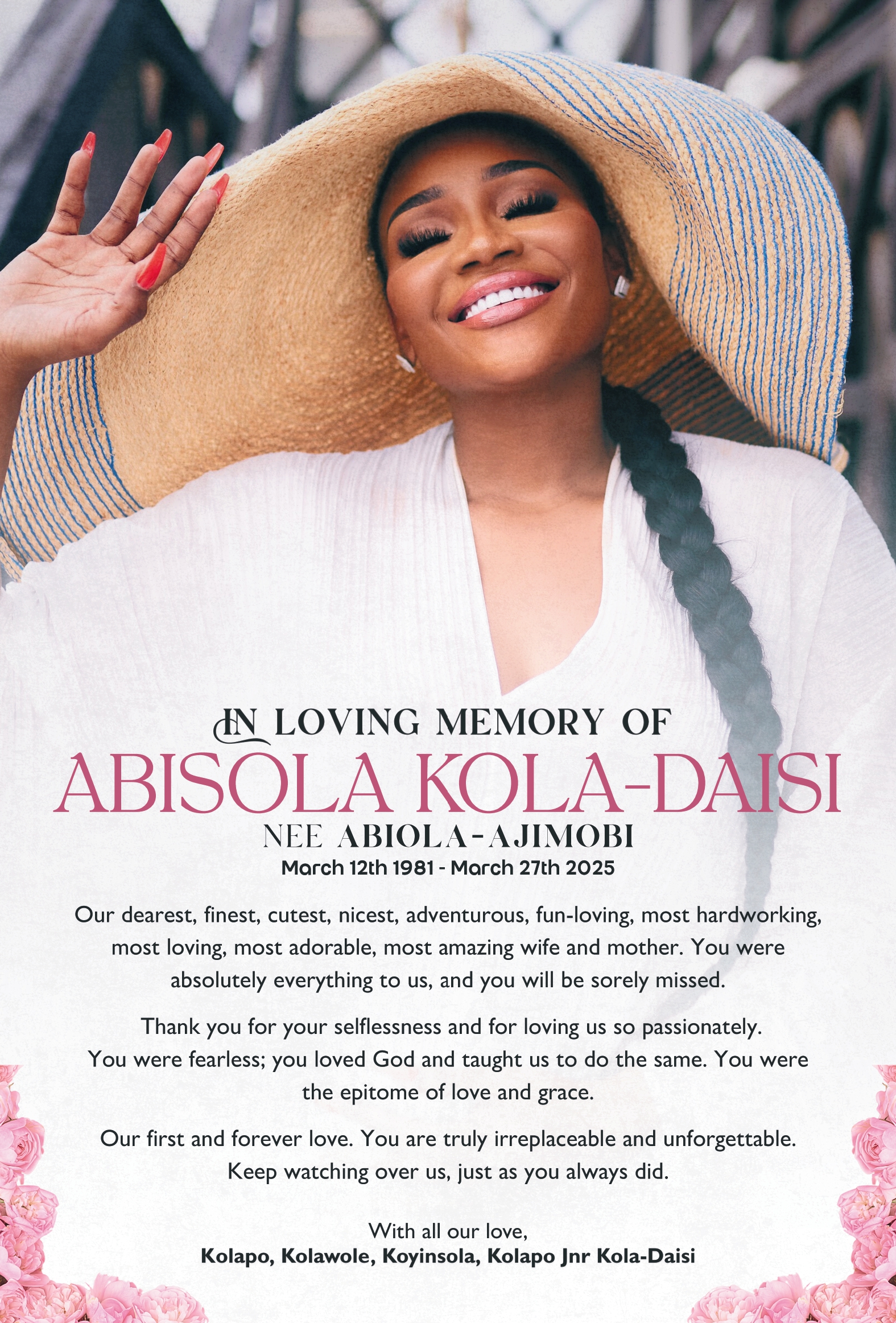

In Nigeria, 40.1% of people are poor according to the 2018/19 national monetary poverty line, and 63% are multidimensionally poor according to the National MPI 2022. Photo: Julian Osamoto RN

The rising cost of living in Nigeria has emerged as a significant and pressing concern, particularly among vulnerable segments of the population.

This multifaceted issue finds its roots in several factors, including inflation, the devaluation of the Nigerian currency, inadequate infrastructure, and inefficiencies inherent within the economy.

As the prices of commodities continue their upward trajectory across diverse sectors, it becomes incumbent upon both governmental bodies and affluent individuals to extend support to those disproportionately affected by this crisis.

Many factors contribute to the rise in the cost of living

Inflation: Historically, Nigeria has grappled with high inflation rates, which have directly influenced the escalating costs of goods and services. This phenomenon is primarily linked to factors such as government borrowing, currency depreciation, and sluggish productivity.

Notably, in June, the National Bureau of Statistics released a report indicating a Consumer Price Index (CPI) increase of 22.79%. This surge, propelled by food price increases, particularly affects those with modest incomes, compelling them to prioritise certain essential items. These economic strains can also exacerbate security concerns, potentially leading to heightened crime rates.

High Poverty Levels: Despite its status as one of Africa’s largest economies, Nigeria continues to grapple with a significant poverty rate. This reality means a substantial portion of the populace struggles to afford basic necessities, subsequently intensifying demand and driving prices upward.

Fluctuations in Exchange Rates: Nigeria heavily depends on imports, including petroleum products. Consequently, any fluctuations in exchange rates can exert a substantial influence on the overall cost of living.

When the naira weakens against foreign currencies, the cost of imported goods naturally surges.

In a recent scenario, the Naira remained at N860/$ for three consecutive days, a reflection of stabilising demand pressure within the parallel market.

The Central Bank of Nigeria (CBN) implemented regulations, including allowable spread limits for Bureau de Change (BDC) operators and the requirement of valid Price Verification reports, to manage the foreign exchange market and stabilise the naira’s value.

Inadequate Infrastructure: Nigeria’s infrastructure, encompassing transportation systems and electricity supply, suffers from notable inadequacies and unreliability. As a consequence, individuals and businesses often resort to costly private alternatives, like generators and expensive courier services, further compounding the financial burden.

Subsidy Removal: Historically, Nigeria has subsidised critical commodities, such as fuel and electricity, to maintain consumer affordability. However, the removal of these subsidies, as initiated by President Bola Tinubu, has sharply escalated living costs.

Weak Social Protection Programmes: Nigeria’s dearth of robust social protection programmes leaves vulnerable individuals and families without adequate support systems. The absence of reliable safety nets intensifies the financial pressure on those already grappling with affording essential necessities.

Corruption and Lack of Transparency: Corruption remains a significant challenge in Nigeria, contributing to inflated prices, resource misallocation, and a lack of accountability in public expenditure. These issues exacerbate the overall economic landscape, further burdening citizens’ costs of living.

People are looking for ways to solve this problem. Some ideas could help in the short term, and others might make things better in the long run.

The government must actively promote fiscal discipline by critically examining and trimming unnecessary expenditures. Concurrently, combating corruption within public finances is essential. A transparent and efficient allocation of public funds ensures that resources are utilised optimally. Such measures not only reduce the strain on government coffers but also thwart the excessive printing of currency, which can contribute to inflationary pressures.

Economic Diversification

Nigeria’s heavy reliance on oil revenue has rendered its economy vulnerable to the volatility of international oil prices. The government should focus on diversifying the economy by strategically investing in sectors such as agriculture, manufacturing, technology, and tourism. This diversification approach creates a more robust economic foundation, generating employment opportunities, boosting productivity, and ultimately curbing the rising cost of living.

Infrastructure Advancement

The inadequate state of infrastructure, spanning areas like power supply, transportation, and healthcare facilities, considerably amplifies living costs for Nigerians. A committed government investment in infrastructure development is pivotal. Simultaneously, creating an environment that attracts private investment through sound policies and regulations is necessary to bridge these infrastructural gaps.

Social Safety Nets

The immediate impact of escalating costs hits vulnerable populations, particularly the impoverished and unemployed, the hardest. Implementing targeted social safety nets, such as cash transfer programmes and subsidies, can provide crucial short-term relief. These safety nets should be meticulously designed and implemented to ensure that those most in need receive timely assistance.

Education and Skill Enhancement

Investing in education and skill development is a fundamental strategy to empower Nigerians to compete in the global job market. Access to quality education and training equips individuals with the tools they need to secure well-paying jobs, which in turn increases income levels and alleviates the burden of rising living costs.

Monetary Stability

The Central Bank of Nigeria plays a pivotal role in stabilising the country’s currency and combating inflation. Adhering to prudent monetary policies that effectively manage monetary aggregates, interest rates, and foreign exchange reserves is crucial. This fosters monetary stability, which contributes to a predictable economic environment and reduces inflationary pressures.

Consumer Safeguarding

The government’s enforcement of robust consumer protection laws is essential to ensuring that citizens are not subjected to price gouging, unfair business practises, or monopolistic behaviour. These measures create a level playing field in the marketplace, protect consumer rights, and prevent exploitative price hikes.

Entrepreneurship and Small Business Support

Encouraging entrepreneurship and providing support to small businesses contribute significantly to economic growth. These initiatives generate jobs, foster competition, and often lead to decreased prices for goods and services. Government policies that incentivise entrepreneurship and ease the regulatory burden for small businesses can have a positive impact on living costs.

To effectively address the escalating cost of living, it is imperative to engender a holistic and synergistic approach that integrates the efforts of the government, private sector, and civil society.

The execution of these all-encompassing strategies holds the potential to ameliorate the fiscal burden borne by the populace, elevate their overarching standard of living, and lay the bedrock for the continuity of sustainable economic progression.